The global gacha gaming market saw significant shifts in July 2025, with top titles competing closely for revenue dominance. Genshin Impact led the charts once again, driven by the release of a highly anticipated character.

Meanwhile, other favourites like Love and Deepspace and Pokémon TCG Pocket experienced notable changes in performance.

This report delves into the revenue rankings, trends, and market insights that shaped July 2025, offering a comprehensive look at the evolving landscape of gacha-based mobile games.

What Are the Key Revenue Trends for Gacha Games in July 2025?

Gacha game revenues in July 2025 reveal both expected performances and surprising changes. Following the strong surge from Genshin Impact in June, July continued the trend of aggressive monetisation by top-performing games. The monthly charts indicate shifts in consumer spending patterns, content effectiveness, and developer strategies.

Titles that released highly anticipated characters or ran successful events saw significant gains. Others, particularly those lacking new content, experienced notable drops. While top-tier games maintained strong positions, mid-tier games fluctuated depending on event timing and regional promotions.

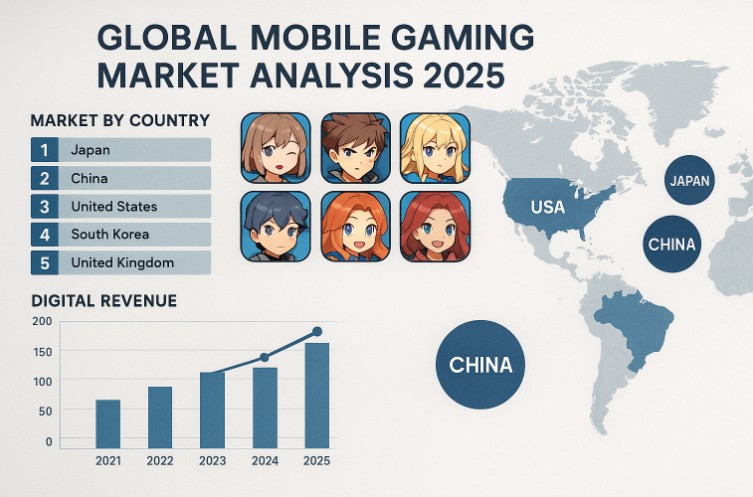

Global player behaviour also showed varied results, with Asian markets still leading in per-user spend, but Western markets like the UK and US showing increased adoption of the gacha model.

Which Gacha Games Ranked Highest in July 2025?

The rankings for July reflect a competitive field with familiar leaders and new entries. Genshin Impact held its first-place position after topping the chart in June, driven largely by the character Skirk. Love and Deepspace maintained a close second, while Pokémon TCG Pocket continued to slide after a high-performing spring.

Top Performing Gacha Games by Revenue – July 2025 (Estimated)

| Rank | Gacha Game | Estimated July 2025 Revenue | June 2025 Revenue |

| 1 | Genshin Impact | $68,200,000 | $65,505,000 |

| 2 | Love and Deepspace | $55,000,000 | $53,650,000 |

| 3 | Pokémon TCG Pocket | $48,500,000 | $52,000,000 |

| 4 | Seven Knights Re:BIRTH | $41,700,000 | $40,000,000 |

| 5 | Wuthering Waves | $40,300,000 | $39,700,000 |

| 6 | Zenless Zone Zero | $39,150,000 | $38,340,000 |

| 7 | Naruto Mobile | $23,100,000 | $24,750,000 |

| 8 | Fate/Grand Order | $22,900,000 | $23,575,000 |

| 9 | Goddess of Victory: Nikke | $22,100,000 | $21,950,000 |

| 10 | SD Gundam G Generation ETERNAL | $19,600,000 | $21,000,000 |

Genshin Impact’s rise in July was mainly attributed to sustained banner pulls for Skirk and new story content introduced in the 4.9 update. Its ability to build momentum across multiple months showcases the game’s effective content pacing and community engagement.

Seven Knights Re:BIRTH and Zenless Zone Zero continued to climb, benefiting from recent regional campaigns in Korea and Japan. Meanwhile, SD Gundam G Generation ETERNAL experienced a small drop, possibly due to a lack of high-profile updates or content to retain user interest.

How Do June and July 2025 Revenues Compare for Top Gacha Games?

The transition between June and July 2025 demonstrates how closely gacha game performance is tied to in-game content. Here is a side-by-side comparison of selected top performers across the two months, showing growth and declines in revenue.

Revenue Comparison Table: June vs July 2025

| Game | June 2025 Revenue | July 2025 Revenue | Change |

| Genshin Impact | $65.5M | $68.2M | +$2.7M |

| Love and Deepspace | $53.6M | $55.0M | +$1.4M |

| Pokémon TCG Pocket | $52.0M | $48.5M | -$3.5M |

| Seven Knights Re:BIRTH | $40.0M | $41.7M | +$1.7M |

| Zenless Zone Zero | $38.3M | $39.1M | +$0.8M |

| SD Gundam G Generation ETERNAL | $21.0M | $19.6M | -$1.4M |

Notably, the top five games experienced modest to strong gains in revenue, largely due to mid-summer campaigns and fan-favourite character releases. Pokémon TCG Pocket and SD Gundam posted dips, suggesting their content cycles may need revitalisation to maintain revenue momentum.

What Factors Are Driving Gacha Game Revenues in 2025?

Gacha game monetisation in 2025 is shaped by multiple internal and external factors, ranging from in-game features to global economic trends. Developers who understand and adapt to these factors are seeing continued success.

Character Banners and Limited-Time Events

One of the most influential drivers of revenue is the character banner system, which fuels much of the urgency and excitement around gacha pulls.

When a game releases a highly anticipated character, players are often compelled to spend more to secure them before the banner expires. Genshin Impact’s recent spike in revenue is a textbook example, as the Cryo character Skirk generated substantial spending across multiple regions.

Likewise, seasonal and limited-time events that offer rare characters, cosmetics, or rewards encourage a higher volume of purchases. These events often coincide with real-world holidays or in-game milestones to boost engagement.

Narrative Content and Story Progression

Narrative development remains a strong retention tool for live-service gacha games. Titles such as Love and Deepspace and Wuthering Waves have benefited from continuous story expansions that emotionally invest players in characters and their worlds. The deeper the narrative connection, the more likely players are to support the game financially.

Games that introduce new characters through storyline progression, rather than random drops, also tend to generate positive player sentiment and higher spending rates due to the sense of earned investment.

Regional Events and Localisation Strategies

Tailoring content to specific regions has become essential. Successful gacha titles often run exclusive regional campaigns, celebrating cultural events or local festivals. For example, Korean and Japanese markets regularly see games featuring special updates during Lunar New Year or Obon.

Furthermore, localisation is no longer just about translating text. Full voice acting in multiple languages, culturally relevant character design, and targeted marketing all contribute to higher player retention and spending in different territories.

Player Loyalty and Psychological Investment

Gacha games often capitalise on the sunk-cost fallacy, where players who have invested time and money feel incentivised to continue. This psychological factor is built into many progression systems, daily rewards, and login bonuses.

Games also reward long-term loyalty through subscription systems or “whale” bonuses that unlock VIP tiers, which further encourages continued investment from high-spending users.

Which Market Trends Are Shaping the Gacha Gaming Industry?

Beyond individual game mechanics, the broader industry landscape is evolving due to shifts in player expectations, technology, and business models. Gacha developers in 2025 are increasingly data-driven and innovation-focused.

Monetisation Beyond Traditional Gacha Mechanics

While traditional gacha mechanics still dominate, several titles are expanding their monetisation models. Subscription-based systems that offer exclusive benefits and currencies are gaining traction.

These models not only guarantee a baseline revenue stream but also appeal to players who prefer predictability over randomness.

Some games are also introducing battle passes and layered reward systems that combine free and premium tiers, offering cosmetic or material value based on engagement rather than luck. Zenless Zone Zero and Nikke have successfully adopted this model to boost user satisfaction.

Cross-Platform Integration and Accessibility

Gacha games are no longer confined to mobile platforms. Cross-platform play between mobile, PC, and even consoles has become increasingly common. This expansion allows developers to reach wider audiences and drive up playtime, which correlates directly with in-game spending.

Games such as Genshin Impact, with seamless account syncing across devices, are setting a new standard. It encourages players to engage more frequently, no matter their preferred device, which ultimately improves monetisation opportunities.

AI and Procedural Content Generation

Artificial Intelligence is beginning to play a more visible role in the creation of dynamic content. Some developers are using AI to generate procedural events, dialogue options, or even character interactions, reducing development costs while maintaining novelty.

This allows for faster content rollouts and improves the player experience by offering more personalised or varied scenarios. It’s an emerging trend but one expected to become standard in gacha development pipelines in the next 12–18 months.

Community Building and Influencer Marketing

Influencer campaigns and community building efforts are more strategic than ever. Developers are investing heavily in collaborations with content creators, community contests, and live-streamed announcements. These efforts increase game visibility and create momentum around character launches or event rollouts.

Social platforms such as TikTok and YouTube Shorts have become crucial for short-form promotional content. Wuthering Waves and Seven Knights Re:BIRTH saw noticeable bumps in revenue following community events and influencer partnerships during their respective July promotions.

Data-Driven Development and Real-Time Analytics

Developers are relying more on real-time data to inform updates, pricing, and content scheduling. With platforms like SensorTower and AppMagic offering performance insights, studios can monitor what content works, where players are dropping off, and how monetisation strategies are performing across regions.

This shift has made the industry more responsive. Instead of static update cycles, many games now adopt agile content release models, adjusting based on daily user behaviour and engagement metrics.

Which Games Surprised the Industry in July 2025?

A few titles made unexpected moves in the July revenue chart. The continued success of Seven Knights Re:BIRTH stood out, as the game was only released in early 2025. Its rise indicates the market still has room for new entrants if executed with the right content strategy.

Wuthering Waves maintained momentum despite being overshadowed by bigger franchises. Its consistent revenue is tied to quality-of-life updates and a compelling narrative, attracting players looking for alternatives to the more mainstream titles.

The most surprising absence was Honkai Star Rail, which had dropped out of the top ten entirely. Although its last content release was in May, the lack of July revenue presence indicates the game’s dependency on high-profile releases. However, with Phainon’s debut in August, it’s anticipated to return to the rankings.

What Can Be Expected for August 2025 Gacha Game Revenues?

August is poised to be a competitive month. Several anticipated events and banners are scheduled to launch, including Genshin Impact’s regional expansion, new banners in Fate/Grand Order, and anniversary celebrations in Goddess of Victory: Nikke.

Expected trends for August:

- Major revenue gains from anniversary events

- Return of Honkai Star Rail to the top charts due to new 5-star character releases

- Strong ongoing performance from Love and Deepspace with its story chapter expansions

- Increased competition from emerging titles like Arknights: Endfield and Final Fantasy VII: Ever Crisis, both expected to launch new global updates

With live-service games becoming the standard, developers are pushing harder to retain player engagement between major updates. August will be a crucial month to gauge the long-term viability of many mid-tier gacha games trying to break into the top five revenue rankings.

Conclusion

The gacha landscape remains volatile yet vibrant. July 2025 solidified Genshin Impact’s position as a leader, but consistent innovation and strong community engagement are essential to maintaining that edge.

As new titles emerge and established games evolve, understanding revenue shifts becomes crucial not just for developers but also for players and industry observers.

Frequently Asked Questions (FAQs)

What factors influence gacha game revenue month to month?

Gacha revenue is influenced by character releases, limited-time banners, events, marketing campaigns, and community engagement. New content drives player spending significantly.

Why did Honkai Star Rail drop from the top ten in July 2025?

Honkai Star Rail likely experienced a temporary content gap. With no major releases in July, players may have reduced spending. A return is expected in August.

How accurate are revenue estimates for gacha games?

Estimates are based on data from platforms like SensorTower and AppMagic, which use download and spending metrics. While not exact, they provide strong industry benchmarks.

Are newer gacha games performing better than older ones?

Yes, in many cases. Titles like Seven Knights Re:BIRTH and Zenless Zone Zero are gaining ground due to fresh gameplay, better graphics, and more aggressive monetisation strategies.

What role does character popularity play in revenue spikes?

A major one. Popular characters, especially those teased for months like Skirk in Genshin Impact, lead to massive spending surges during their release weeks.

Which regions contribute the most to gacha game revenue?

Japan, China, and South Korea are traditionally the highest contributors. The US and UK are growing in relevance due to cultural adaptations and better localisation.

Is the gacha game market still growing in 2025?

Yes, the market is still expanding. Although growth has slowed compared to pandemic peaks, new titles and tech innovations (e.g., AI-enhanced events) keep it thriving.